How can Intelligent Bank and Mobile Money Statement Analysis Streamline your Loan Underwriting?

Unlock the power of borrower transaction data for lending decisions.

Smart Transaction Categorization:

Forget tedious manual categorization! Let Cladfy automatically extract, classify, and compute transactions in bank statements, saving you hours of work. Imagine:

AI-powered intelligence: Cladfy learns from your historical data and industry trends to accurately categorize income, expenses, and other transactions.

Customizable categories: Tailor categories to your specific needs, ensuring accurate data for analysis and reporting.

Drill down for deeper insights: Easily analyze specific categories or groups of transactions to gain a comprehensive understanding of borrower finances.

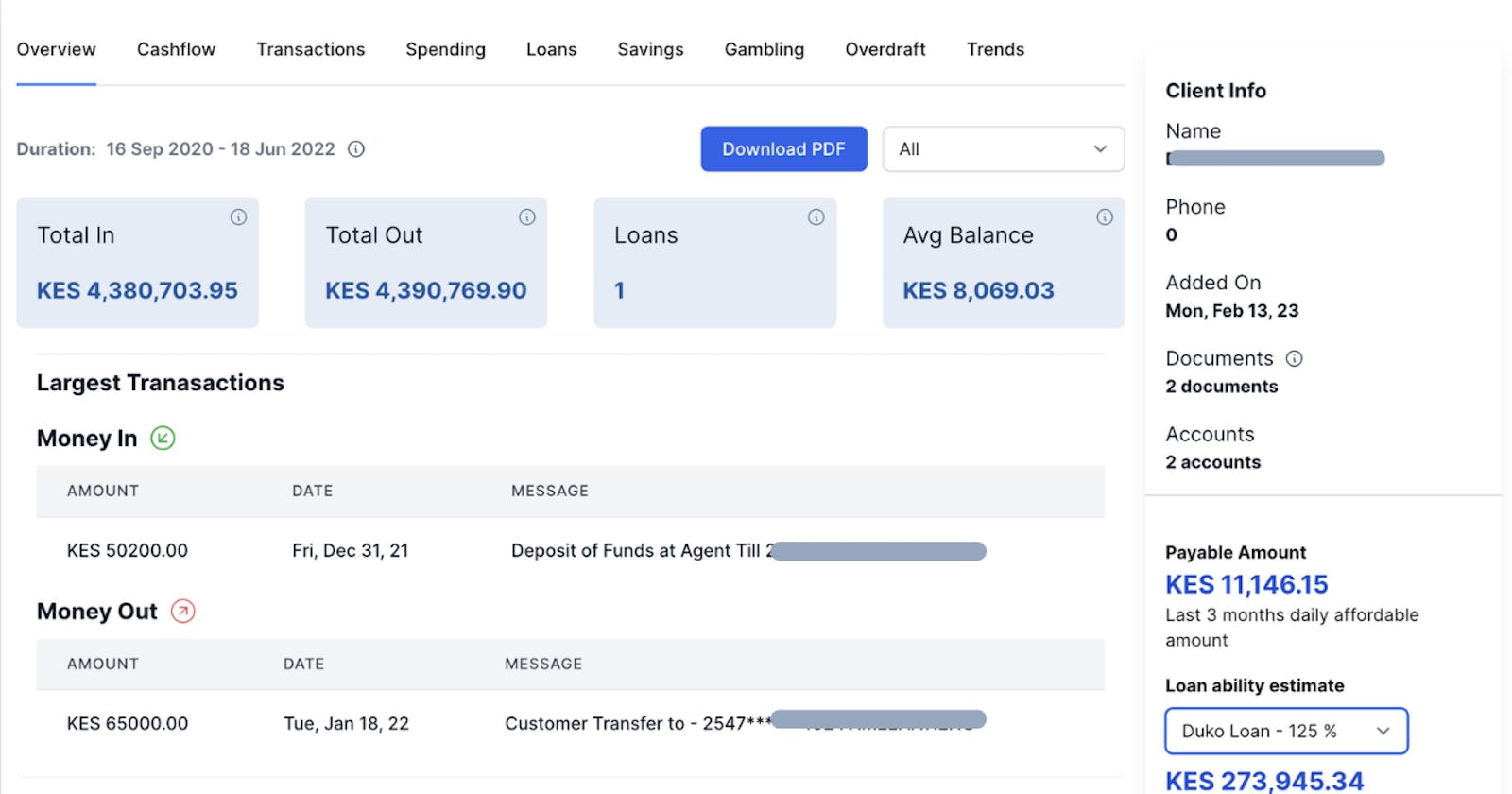

Loan Ability Estimates:

Go beyond simple income verification. Cladfy leverages extracted data to generate preliminary loan ability estimates in minutes. This empowers you to:

Pre-qualify borrowers quickly: Streamline the initial application process by providing fast, data-driven loan feasibility assessments.

Set clear expectations: Give borrowers a realistic picture of their borrowing potential, fostering trust and transparency.

Focus on qualified leads: Allocate resources efficiently by prioritizing applications with higher chances of approval.

Seamless Integration:

The Cladfy software integrates with your existing lending management system (LMS), eliminating the need for disruptive changes:

No complex setup: Our pre-built connectors ensure smooth integration with popular LMS platforms.

Data flows effortlessly: Transactions data automatically populates relevant fields in your LMS, saving time and reducing errors.

Centralized data management: Access and analyze all loan data within your familiar LOS environment.

Scalable and Secure:

Cladfy is built to handle your growing needs and protect sensitive borrower information:

Cloud-based scalability: Our infrastructure scales automatically to accommodate increasing data volumes and user demands.

Advanced security measures: Industry-leading security protocols safeguard your data, ensuring compliance and peace of mind.

Regular audits and penetration testing: We continuously evaluate and strengthen our security posture to stay ahead of threats.

In short, Cladfy doesn’t give you just another data extraction tool; you get a comprehensive solution designed to transform your loan underwriting process. This gives you the power to confidently approve more loans and delight your borrowers.