Navigating the Loan Application Lifecycle: The Power of State Machines

Efficiency and Control in Lending Management Systems

State machines serve as the rails during lending, making the loan process smooth and efficient by ensuring loan applications seamlessly move through each step.

A state machine is like a flowchart that helps describe and control how things work. It shows the different steps something can be in, how it moves from one step to another, and what makes it move.

State machines are important tools in software development where they help in understanding and managing how different parts of a system or process behave.

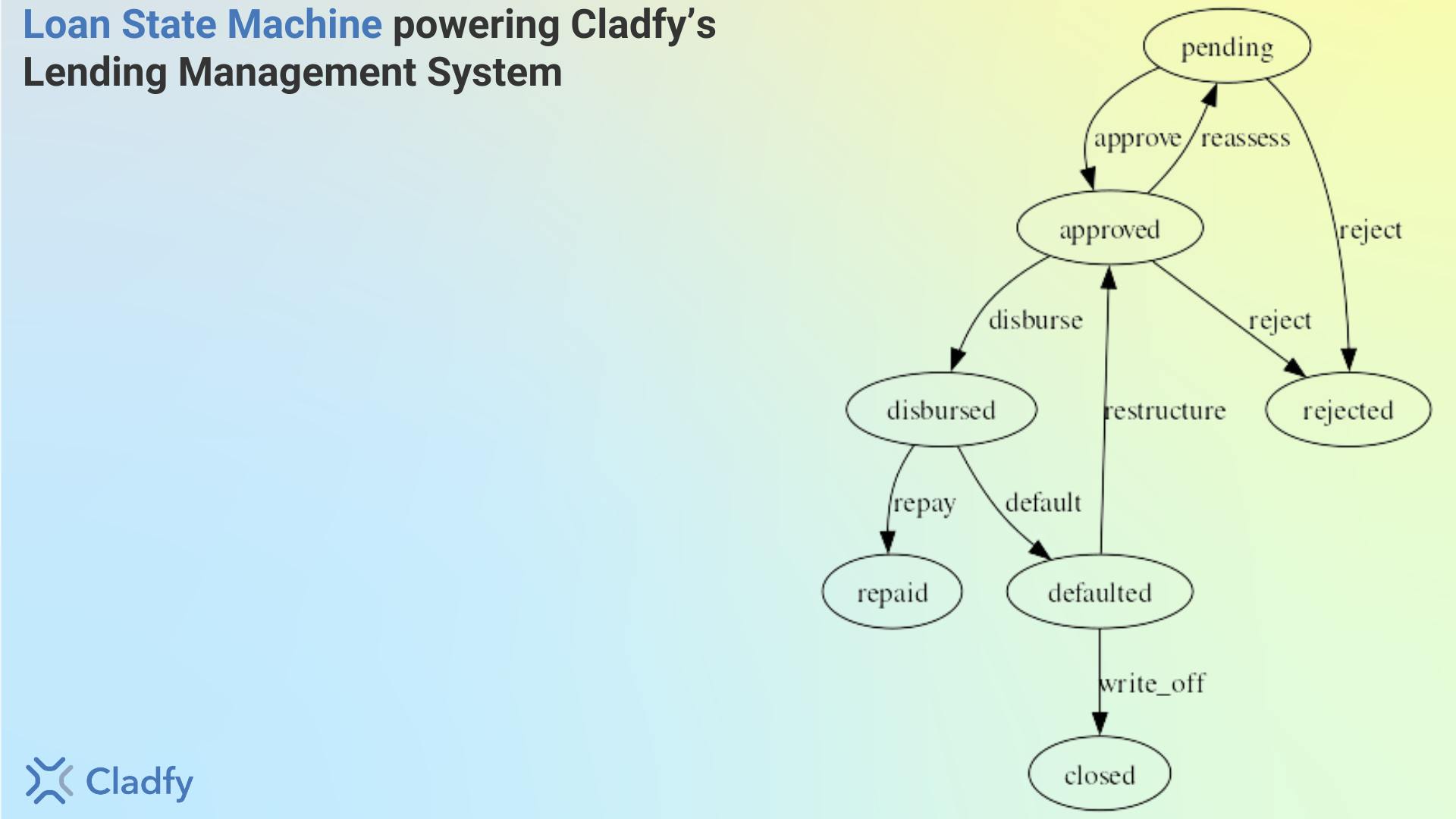

In a Lending Management System (LMS) a Loan State Machine is used to model the different states and transitions that a loan application goes through as it progresses from submission to approval or rejection, repayments, and closure.

Below is a snapshot of a state machine inside the Cladfy Lending Management System. It has become instrumental in visualizing, tracking, and managing the different states of a loan application through its lifecycle.

Note: You can add additional states and transitions as needed to capture the specific workflow and business rules of your loan application process.

Closer Look.

Imagine a loan application as a journey with different steps. A state machine for a loan application helps keep track of where each application is in the process and what actions are needed to move it forward. Here's how it works:

States: Think of these as the different stages that a loan application can be in. For instance, it can start in the "Application Submitted" state.

Transitions: These are like the routes or paths that an application can take from one stage to another. For example, from "Application Submitted," it can transition to "Under Review" when a loan officer starts looking at it.

Events: Events are like the triggers that make an application move from one stage to another. For a loan application, an event could be something like "Loan Officer Review," which moves it from "Application Submitted" to "Under Review."

Example.

Here's a simplified version of a loan application state machine:

Application Submitted: This is the starting point when a customer applies for a loan.

Under Review: The application is being evaluated by a loan officer.

Approved: If the application meets all the criteria, it moves to the "Approved" state.

Rejected: If the application doesn't meet the requirements, it goes to the "Rejected" state.

Funded: After approval, the loan is funded, and the application reaches the "Funded" state.

Closed: When the loan is repaid, the application is marked as "Closed."

Each of these states and transitions helps a lender understand where each application stands in the process. It ensures that the right actions are taken at the right time, making the loan approval process more organized and efficient.

Conclusion.

Discover and leverage the power of state machines in technology and finance to simplify your lending operations today at www.cladfy.com